offerings

According to the self-storage Almanac, publicly traded companies own less than 25% of the self-storage market. A majority of facilities are under mom-and-pop ownership. There is a consolidation opportunity for Investa Capital to acquire facilities in secondary and tertiary markets that are value-add in nature. Rebranding and deploying a professional management strategy will deliver strong returns to our investors. Our new development focuses in markets that are under supplied and high barriers to entry.

portfolio

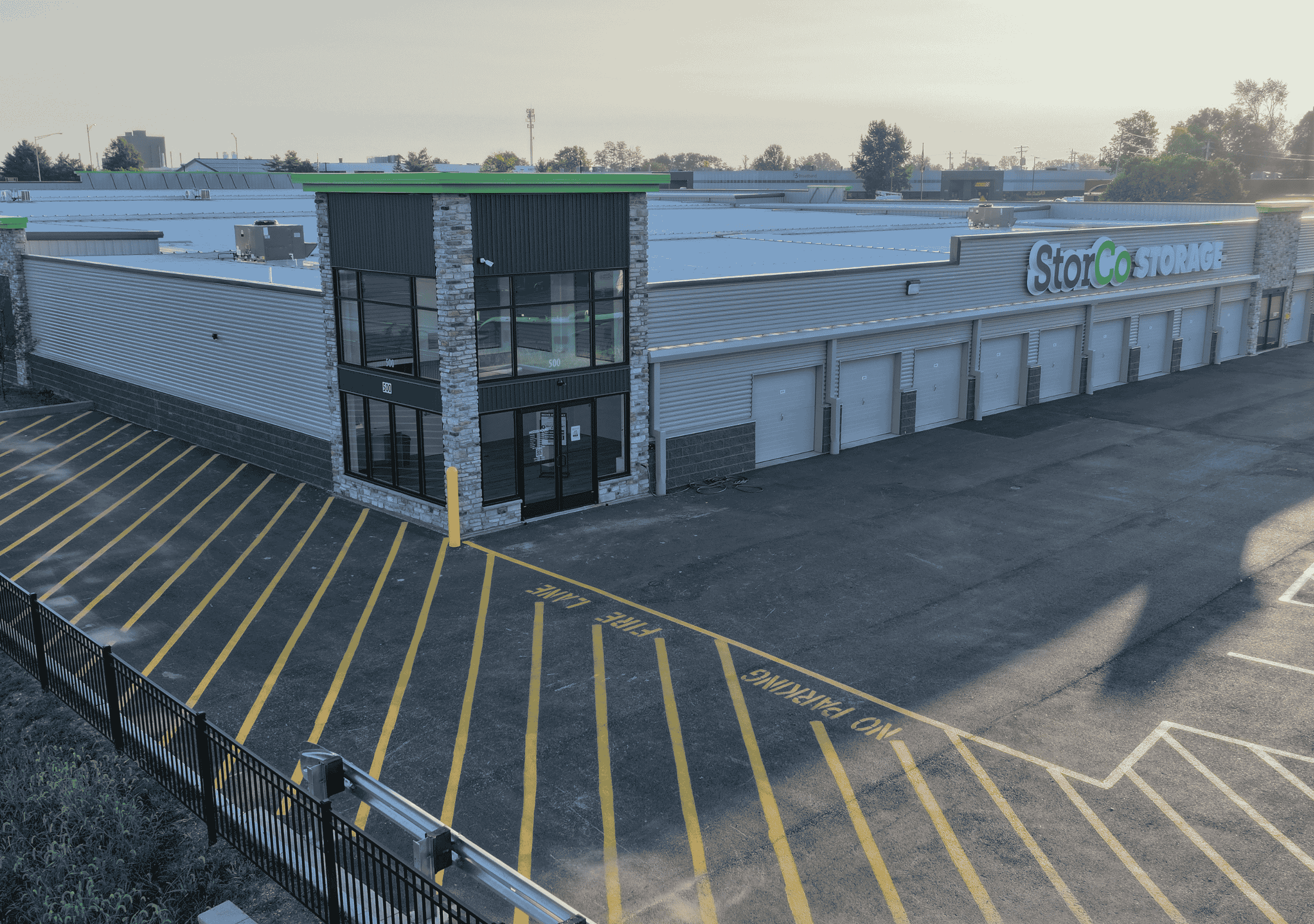

O’Fallon, MO

Conversion of a trampoline park. Over 50,000 sqft of build with 21 ft ceiling heights provided an opportunity for a two-story conversion. The 13,000 sqft retail center provided in-place cash flow from day one. Expansion possibilities with over 7 acres. Purchase price well below replacement cost providing even more upside to our investors.

O’Fallon, MO

Conversion of a trampoline park. Over 50,000 sqft of build with 21 ft ceiling heights provided an opportunity for a two-story conversion. The 13,000 sqft retail center provided in-place cash flow from day one. Expansion possibilities with over 7 acres. Purchase price well below replacement cost providing even more upside to our investors.

Wood River, IL

Previously a car dealership with over 90,000 sqft of building providing a great opportunity for a storage conversion. Expansion possibilities with over 15 acres. In place cash flow from existing retail tenants. Purchase price well below replacement cost providing even more upside to our investors.

Wood River, IL

Previously a car dealership with over 90,000 sqft of building providing a great opportunity for a storage conversion. Expansion possibilities with over 15 acres. In place cash flow from existing retail tenants. Purchase price well below replacement cost providing even more upside to our investors.

St. Peters, MO

Strategically positioned with 90,000+ vehicles passing daily, our facility offers a diverse unit mix to meet a variety of storage needs. With expansive square footage and multi-phase expansions planned, we provide a scalable, high-demand investment opportunity in a thriving market.

St Peters, MO

Strategically positioned with 90,000+ vehicles passing daily, our facility offers a diverse unit mix to meet a variety of storage needs. With expansive square footage and multi-phase expansions planned, we provide a scalable, high-demand investment opportunity in a thriving market.